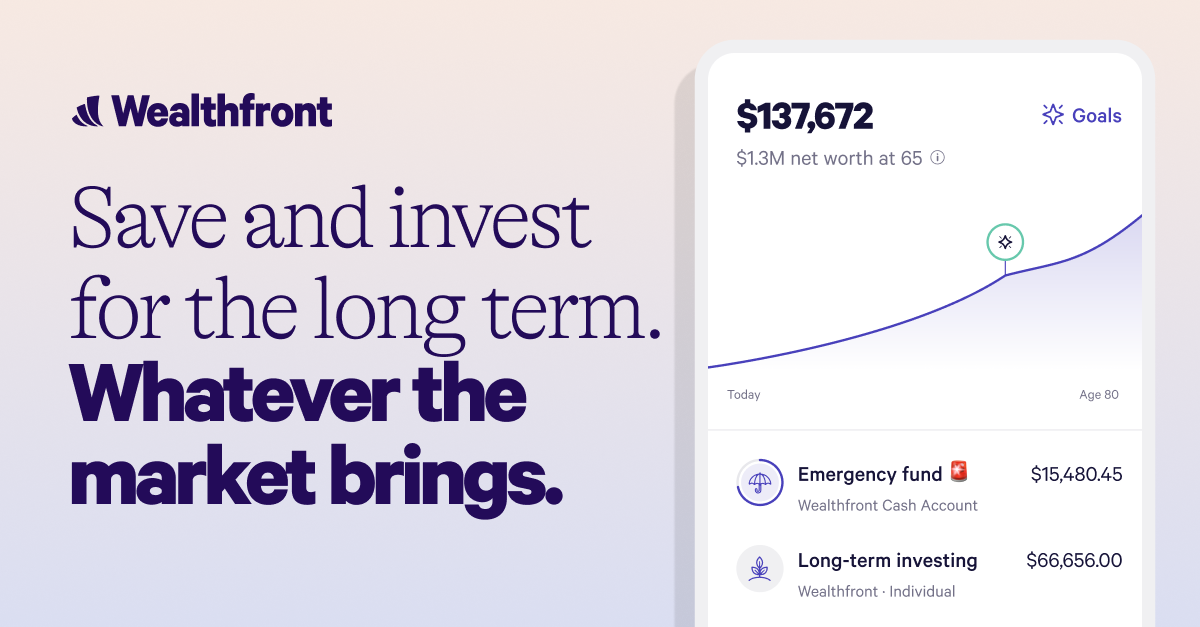

A buddy of mine told me about Wealthfront recently and they’re 5% money market account rates.

Growing up in a world where savings accounts and even CDs never approached more than 2%, the rates on this new thing blew me away.

Free money is great, and I’d love to take advantage of these rates, but the only cash I have currently is the emergency fund I’m trying to build.

Anyone have thoughts on if putting an efund in this kind of service is a bad idea? Not sure if it’ll be liquid enough if a major expense comes up.

It’s just a bank account at the end of the day, and it’s FDIC-insured, so why not?

I’m using SoFi right now (4.5%), but I’d switch to Wealthfront in a heartbeat if they had joint account support. They’re always very fast to raise the rate when the fed announces a rate hike, and they seem generally pleasant to use from what my coworkers say.