No. The amount of stock you can afford, the influence you have over the company, and the amount of benefit from owning stock is negligible compared to actual bourgeois.

Saying that you own the company by buying shares from robinhood is like saying America is democratic because you get to vote.

I believe doing what you can to keep yourself afloat and release yourself to be able to radicalize and organize those around you is an important goal. We can fall prey to ultra leftism and stunt our own progress by trying to maintain “purity”, and be “exploitation free.”

It’s a matter of scale. You can be a small time landlord and it would be nowhere near as bad as a large property management conglomerate. You’re still not safe. Same for investing. Study theory, make praxis, and don’t fall into opportunism.

I’m leaving this up, I misread the question lol you’d be the petitest of bourgeois! Lol extra points if you find a way to reinvest your dividends and complete the M-C-M cycle. Hahaha

Also, are you saying that one can be a landlord while also being a communist?

You could even own a factory… Lol

And at the same time write the most important communist piece in history!

But wouldn’t owning factories make you a class traitor?

The person I was aiming at is Engels, who came from a factory owning family. He did not technically completely own a factory (without going into too much details) but he was still born in a bourgeoisie family and profited off the labor of others. You could call Engels a class traitor for this but he still wrote some of the most important communist theory out there. Sometimes it’s not that black and white.

But wouldn’t that make someone a class traitor?

Yes?

I meant that isn’t being a communist factory owner immoral?

Being a class traitor in the Marxist sense is understood to be good if they are betraying the Bourgeoisie. The position on the Left in general is siding with the Proletariet (workers) against the Bourgeoisie (the owners of the means of production)

What is M-C-M?

Money -> Commodity -> (more) Money If this is your primary means of making money, you are a captialist.

Commodity (often labor) -> Money -> Commodity (stuff you need to live) If this is your means of making money primarily, you are proletariet.

How did you manage to condense the first part of Capital into 2 sentences lol

Money to commodity to (more) money, which is a simplification of capital accumulation, as described in capital vol 1

Don’t horde money in stocks. Invest in your community or in yourself.

In the same way having a 401k or superannuation does.

Which is to say not very much, and the borders of class are a little fuzzy. AFAIK dividends are not the main way to make money off stock any more and I doubt anyone on robin hood was seeing that increase their wealth.

The main way to make money off stocks is actually to use marxism.

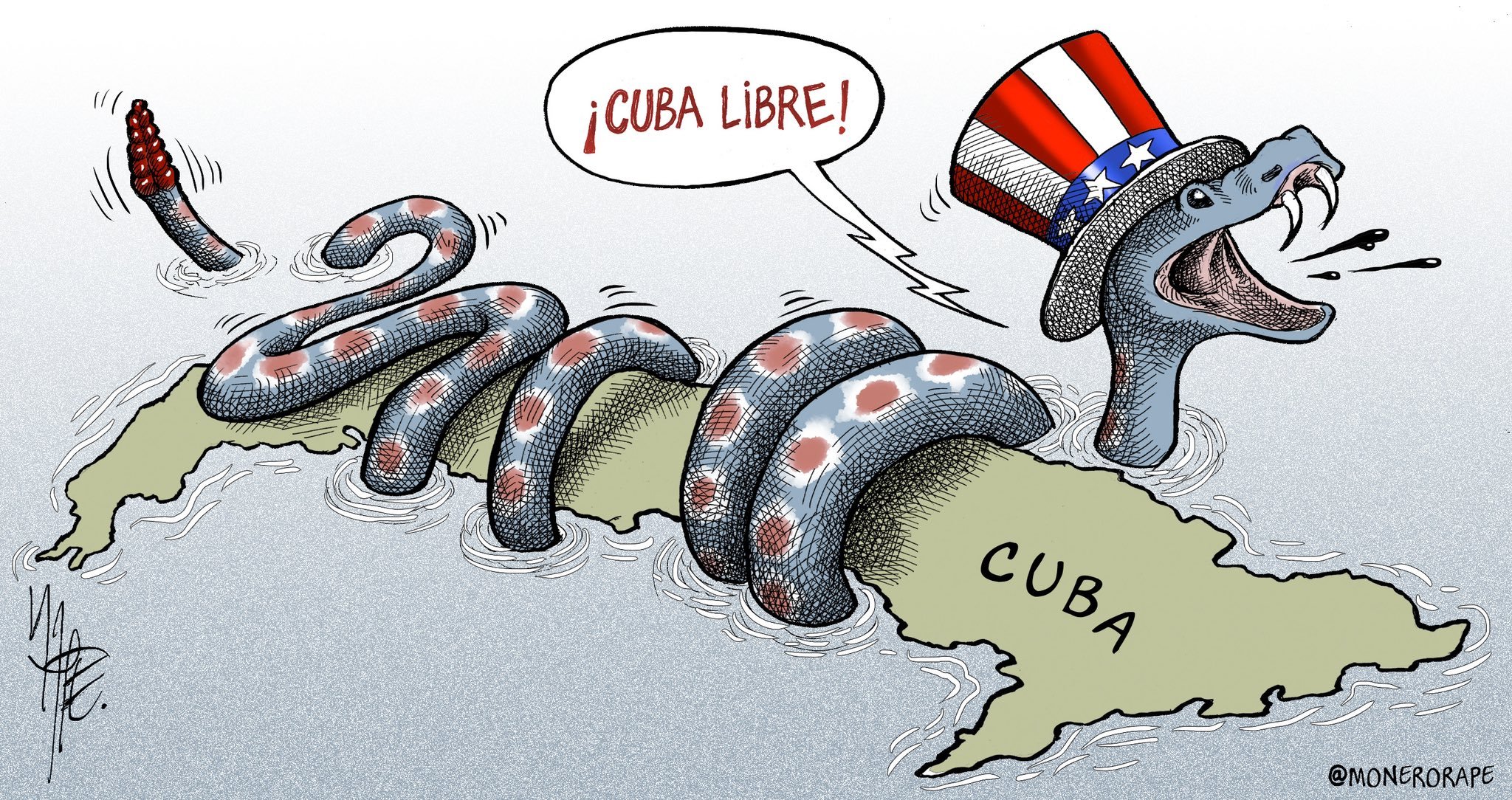

If you’ve read and understood Marx and Lenin, then you can use the theory to make great returns. It’s simple. Just find the most exploitative, evil, reactionary company in the most exploitative, evil reactionary country (the US) and invest in that. I’m talking about companies like mueller industries, Berkshire Hathaway, and HCA.

The US will do whatever it takes to give returns to “their” capitalists. The market has proven this theory time and time again.

Praxis, but bourgeois praxis.

Classic “Marx making 50k GBP on the stock market” vibes

One problem is that these companies are so vulture like you can’t trust them to be honest about their earnings. Most of it is hidden in sister and daughter companies abroad to minimise domestic taxes. And much of the rest is used to pay interest on ‘loans’ that the true owners give to the company to make it seem like the company is in debt.

I’m not saying you’re wrong. Those companies are guaranteed to survive because the state props them up. But for the small-time trader, there might not always be much in it for them.

You remain a proletarian so long as you have to sell your labor power to eat

Even if you are also a landlord?

I don’t think landlords have to sell their labor power to others to eat, since they receive rent

Well… I have a friend who is a landlord and after mortgage fees and all other fees, all that he gets are 300 dollars and he lives in California, so it depends on where the landlord lives and where the property home is.

Don’t see any labor being done… Doesn’t matter where the home is. Same applies to shares.

My question is, let’s say that someone owns private property yet, still has a paying job unrelated to the private property because the surplus value extracted from the private property is not enough for this person to live. Does the fact that this person needs to also sell their labor make them a proletariat or does having any sort of private property make someone a petit burgeois?

Remember Marxist concepts of class are dialectical. They’re not rigid, static categories. The class system is also global, so it’s not possible to determine someone’s class only by looking at their day-to-day life.

Just another instance of class mobility. If for instance this person has to rely on the rent for their main income but works a casual job to supplement it, then their interests lie in protecting that rent.

Lenin cathegorised people belonging to other class but also needing to sell their labour to live as “half-proletarian”. Usually he meant peasants having too little land to live from, but i think it can be also used for this kind of small time renters.

They key to that was that such situation is usually not stable, capitalism eventually will shove those people to become fully wage labourers, similar to the petit bourgeoisie and small scale landowners.

How much rent does the tenant pay?

Two points.

First, the tenant is paying the mortgage. So while your landlord makes $X in monthly income ($X x 12 in annual income), they make $Y in capital accumulation. That is, their tenant is buying the landlord a property and giving the landlord a monthly income.

Even if the mortgage is interest only, the landlord benefits from property appreciation (house prices going up) for as long as the tenant keeps the bank happy with mortgage payments.

$3600/yr plus a free house in Cali to live in or sell at retirement isn’t a bad deal for doing zero work. If all or a portion of that income goes towards the mortgage for the property where the landlord lives, the tenant is really paying off two mortgages, not one.

Second, the portion of the rent that goes to pay taxes, interest, agency fees, etc, is still rent. The landlord facilities all these other scummy practices. Additionally, if there is ‘only’ a $300 cushion, the landlord is likely to immediately pass on any increase in fees, interest, taxes, expenses, to the tenant in the form of charges or increased rent. That kind of thing makes it very difficult for tenants to plan for the future and probably increases the likelihood of eviction if they can’t get a pay rise the next time the landlord ‘has to’ put the rent up.

I’d suggest that those landlords who are doing the buy-to-let thing are liable to being worse landlords than others. How much can/will a landlord pay to maintain the property if they have conceptualised the whole thing as them ‘only’ earning $300/month? (For doing nothing except ‘own’ a deed, which on a mortgaged rental property is effectively a small partnership with an imperialist bank.)

I should add a caveat. This is just to lay out the facts. I’m not overly concerned with small landlords like this. It’s not much different to investing in a pension is stocks and shares or buying government bonds. It’s also relatively insignificant in comparison to the functional exploitation by western labour aristocrats of proles (in the global north but mainly in the global south). (In simple terms: western workers get paid so much only because global south workers get paid so little.)

No but using Robinhood is not a good idea because they screw you on your purchases and lend your shares out without your knowledge or your concentration because, like all brokers in the US, you do not own the rights to those shares. All you are actually buying is an IOU from Robinhood for that stock. If you are going to buy stock you should do so with the companies transfer agent, not through a broker. By utilizing a transfer agent your shares will be in your actual name and cannot be used by brokers to short sell the stock and devalue it.

Honestly if you are in the US you should really just avoid the stock market as much as you can. It is a ponzie scheme invented by the oligarchy to steal wealth from the working class. That has always been how it is used and it’s only gotten more intricate in how they can fuck you over the years. Check out the movie “The Big Short” and it’s just the tip of the iceberg on how fucked the US stock market is.

What’s Robinhood?

A stock trading app

In that case, it depends. Someone who can consider putting ‘spare’ money into stocks like this are probably some variant of labour aristocrat before they get started.

I will say, though, to be extremely careful. If I were to use such an app (I wouldn’t), I would expect to lose everything I put into it. I’ve seen adverts for this kind of thing and adverts for ‘training’ to use them and they are predatory af. Do not go into it unless you are willing to lose money. I’m sure someone will come along and say, ‘it’s not a scam’, etc, but that wouldn’t change my view.

It is a scam and if you don’t know what you’re doing, you’re essentially gambling.

To start, you’ll need some background in micro/macroeconomics and geopolitics, know how to read financial statements, and how to build/manage a portfolio based on risk tolerance. It also helps a lot to know a bit of programming to speed up analysis. I’d estimate that you need around 8 years of experience studying, backtesting and following the market before you can manage a fund successfully.

Alternatively you can just put it all into an index fund.

So, generally, learn how to do it yourself, or put it into an index fund. Everything else is a scam / gambling.

This sounds like great advice to me.

There are probably unexpected legal uncertainties, too. Like is the app a broker, trustee, agent? What are the implications? Does/When does title pass? Who’s responsable for insurance? Etc, etc. I’m sure these kinds of apps have some ‘straightforward’ way of dealing with all this. Straightforward until a trader with $1m+ is caught up in bankruptcy case, owing $2m+ to others and everyone with a possible interest starts competing to say the stocks are theirs. That won’t really be an issue for small-time traders, because unless they get a lawyer, they’re likely at the mercy of whether the app says is the law.

To answer your questions, the app is a broker. The app buys from a kind of holdings firm run by banks, and holds it in your stead. So you never actually own the stock. The transfer from banks to RH takes a couple days. There’s material that details the structure of electronic brokers like these but it’s been a while since I reviewed it.

There is no insurance so you’ve got to purchase it yourself. Generally speaking you are responsible for your losses. Your best bet is to diversify and size your positions to manage risk.

Also, you can open an account that doesn’t allow you to use leverage to trade. So you can’t lose more than you invest. If you want to open a TFSA then this is mandatory.

The value of stocks is disconnected from the book value of the company. So if there is a bankruptcy case and the stock is delisted, then their price just goes to zero. For example, look at the price history of Sears. The writing was on the wall for at least a year before it was delisted.

However you’re right in that the app will do shady things like prevent you from only buying a stock, but allow selling, as was the case for GME. Or if you’ve bought YNDX, then it would be violating sanctions to hold it. But they’ve also forbid trading so you can’t sell it, so you keep getting emails telling you that you’re holding forbidden securities and that you need to sell but you can’t. Etc.

Thanks for the detail :)

you owning some stock doesn’t have to define your politics. many revolutionaries and Marxists benefitted from capitalism and privilege. downtroded, illiterate people in abject poverty won’t develop revolutionary theory, organise an international movement, restructure the economy, and so on.

this question only matters in terms of class. what are class interests of workers in the West with spare funds to invest in stocks and spare time to spend on social media. what are their allegiances, their revolutionary potential. those are valid questions if you are looking to build a movement with them.

i can’t recommend Zak Cope’s “Divided world, divided class” strong enough if you’re interested in Western labour class dynamics.

No, I don’t have a better answer than that, but no I don’t think so