Qualcomm being the only company allowed to sell 4G SOCs to Huawei was a bullshit move in the first place.

The only reason Qualcomm sold so many to Huawei was because the US blocked Mediatek and UNISOC. The US government never gave a legitimate reason why they never granted permission to the competition that applied to supply Huawei.

Sanctions really are the biggest own goal.

It would be the LEAP not the PD-14 in the MC-21, if not for sanctions. In normal conditions, it’s a winner takes all market no matter how tiny the difference is every cent counts to carriers. Only the single most efficient engine available would’ve made sense and it turns out sanctions did just that.

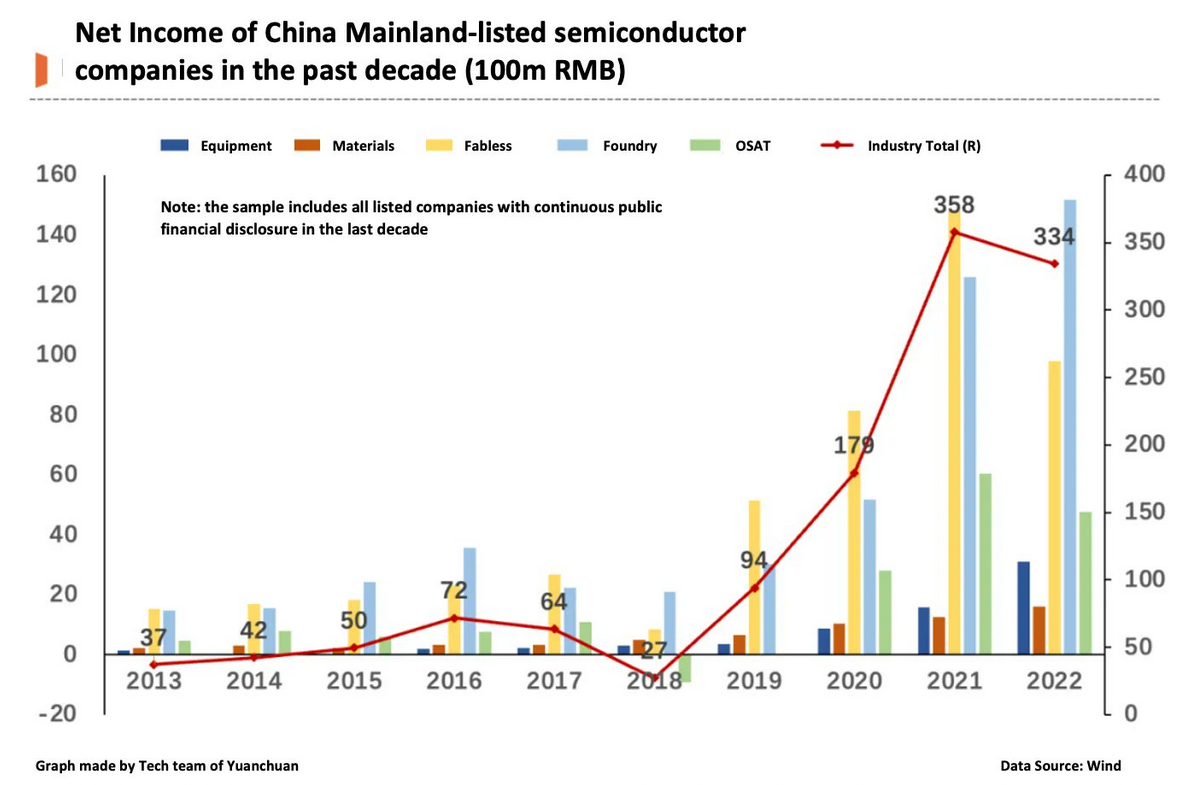

The sanctions are the largest boon to Chinese semi tool companies; they were snubbed by big name Chinese tech beforehand. Now, fear and uncertainty of supply weighs down the western competition. ASML in China has been brought down to SMEE’s level; next year, ASML can’t sell anything more advanced than what SMEE can make.

SMIC would have the same issues as Global Foundries did with justifying the investment in 7nm. The few fabless companies in China that use leading edge processes are wedded to TSMC. If Huawei wasn’t there as a guaranteed customer, SMIC wouldn’t have been able to get their investment to pay off. Huawei didn’t even consider domestic alternatives outside of what they themselves make before the sanctions. The Mi 10 Ultra, with a QCOM SoC, had more domestic parts than the Huawei equivalent.

Even advanced engines can’t redeem the F-35 though, it’s still slower than the JF-17.