We need to stop talking about inflation and start talking about how WAGES ARE NOT GOING UP! Greedy corporations are not PAYING PEOPLE WHAT THEIR LABOR IS WORTH!

The problem is WAGE STAGNATION, not inflation.

The problem is both…

Some inflation is a good thing. It keeps money moving, which is absolutely crucial to the system as it is. Wages do need to rise with or outpace it, though.

But I don’t like the system as it is.

The only way to save for retirement (within this system) is by exploiting other workers. I want overall consumption to decrease. I don’t like how every business is shortsightedly focused on “this quarter”. Inequality since the 1970s has skyrocketed.

This is a bad system.

a lot of important and good things we can do for climate change like consuming less could make the GDP go down, so you know they’ll panic and find ways to incentivize more consumption if so.

We need to get comfortable with economic degrowth.

Why?

Hear me out. If a $50k wages is $50k 10 years from now and all things stay the same why is that a problem? People at that wage can pay for a certain lifestyle at that wage forever.

Hear me out if all companies have a profit? Why have more profit next year? You can still grow you have profit.

Even loans still work as loans have profit built into them so what is the problem with stagnation

But how could we possibly survive without eternal economic growth???

Wages can’t really outpace it, well not for a long time. This infinite growth mentality is what got us here, both insane price wise and low wage wise, you have to somehow make number go up

I agree that right now we’re facing both at the same time, but either one in isolation would still be a huge problem.

Inflation at the current (reported) rate of ~3-4% is healthy for almost any economy, since it promotes spending your money on high quality, long lasting goods, or investing your money to promote growth of businesses. A little depreciation of money each year dissuades people from sitting on their cash. Even without a stock market and capitalism, inflation is an incentive for people to put their long term savings into government savings bonds, which allows for more public development today without more taxes.

BUT if inflation is too high, (even with wages increasing at the same rate, which never happens) it’s extremely difficult for people to save cash to make large purchases. Any economy that uses money needs for people to be able to afford to wait a while with their money before deciding what to do with it, otherwise people are forced to settle for lower quality goods or whatever investment opportunities are available on short notice. Less time to make wise choices with money means less productive use of that money, meaning a less productive economy overall. Not what we want.

And of course, if wages don’t keep up with inflation, either because inflation is running away or because your government has refused to increase the minimum wage at all since 2009 when the national currency was worth 1.47 times as much as it is today, 15 years later (cough cough), then obviously you’re going to run into some problems with people’s ability to afford things.

That said, I think some shady manipulation to the consumer price index is going on to make the reported inflation figures look a lot lower than the actual increase in cost of living that the majority of people are facing. The biggest offender is housing costs skyrocketing in the past decade, but not uniformly across the US. The result is that areas where this hasn’t been nearly as big of an issue falsely “balance out” critical problem areas, where people are practically being forced to either relocate or become homeless due to how rapidly housing prices have gone up.

There’s just so many different things that need to go right for an economy to be prosperous for everyone who contributes to it, and right now the people in charge of steering that economy are getting kickbacks from the people who stand to benefit the most from taking it off the rails.

In the US, average hourly wages have increased more since 2019 than consumer prices. But as always, focusing on averages overlooks the impact on the lowest paid workers and anyone relying on social welfare payments. These are the areas where income often falls behind prices and it’s why many people still feel like things are getting worse despite the grandstanding from governments about how great their economic management is.

I would argue that averages actually don’t mean dog shit, and that they’re only used to pit the proletariat against each other. There is an absolute minimum someone can make, but there is not absolute maximum. At least not yet.

I just know mine ain’t going up

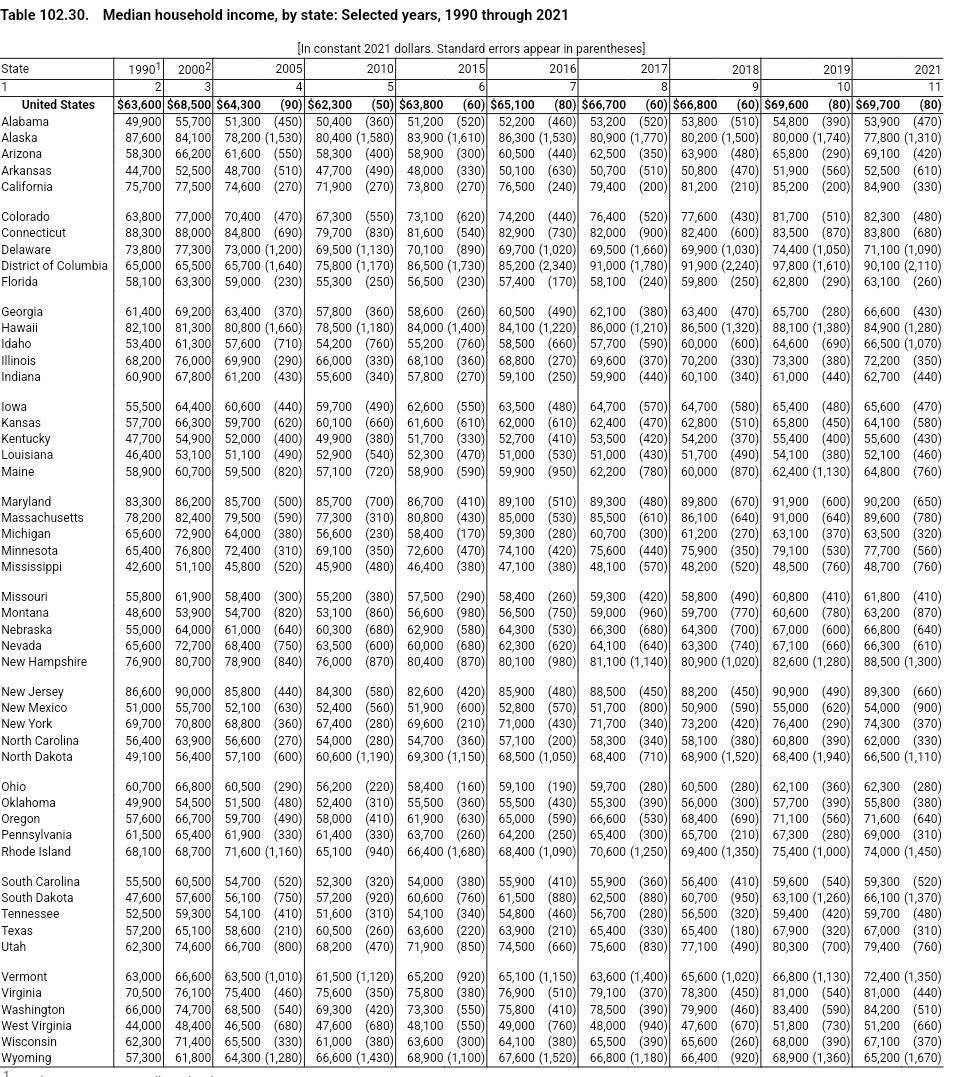

the median household income in America has increased $6,000 since 1990

If this was adjusted for inflation, this increase would be $115,000

https://nces.ed.gov/programs/digest/d22/tables/dt22_102.30.asp?current=yes

We saw a huge raise in wages during the 15minimum push. Still hear the same complaint about not being paid enough. Hell, billionaires get raises, so while I do think people should get more for the work they do (make a company money, earn more money), it definitely isn’t the only thing that has to change.

Scary this has to explained but this is a good eli5.

Yeah many people don’t realize that inflation is “price increase year over year” and think it means “current price.” Like lowering inflation will make their groceries cheaper

Price decreases are actually negative inflation and have all sorts of whacked out effects on an economy. It was a concern during COVID due to the huge drop in consumer spending forcing some prices to start to decrease.

Right, but the messaging doesn’t teach consumers that, it’s just “I’ll lower prices, vote for me!” But regardless, the fact that corporations are so driven towards quarter over quarter growth and immediately fail upon needing to lower prices demonstrates how broken the free market is

In another 20 years business school is going to be SUPER easy.

One class: Number Must Go Up Always.

Lesson 1: Number go down? Fire as many people as possible that aren’t executives.

Lesson 2: Number still go down? Cut quality.

Lesson 3: Number stillllllll go down? Buy competition, repeat lesson 1 and lesson 2.

Profit.

Sadly it seems that’s business school now, as that seems to be the playbook of every MBA that moves into a leadership role

Economics 101 has taught the supply/demand curve forever. Really it’s the barriers to entry lesson that’s much more important.

It’s rare that prices are based on costs. We’re not Amish. Prices are based on what companies can get you to pay and how easy it is for them to prevent too much competition. (If it’s just a little competition, all sides will implicitly agree that higher prices are better for all of them).

fucking amen. If supply and demand was actually followed then we wouldn’t hear this “No OnE WaNtS tO wOrK!” bullshit, they’d properly raise wages since theres a SHORTAGE of workers for them and they have a DEMAND.

but nope. that “law” only applies when they want it to.

Price decreases as a result of the value of money increasing are negative inflation. Mmt proponents seem to have corrupted the definition to be any price increase is inflation and any decrease is deflation though.

As I explained to my boss, you are paying me less if inflation has gone up, and I didn’t get a raise to at least match the rise. Bro started to explain to me how any child would run a lemonade stand with this piggy look in his chubby eyes. Business Budda needs a punch to the gut.

Hey, I was told that everything that goes up must come down. So where the hell is the deflation?

I know this is a joke but deflation can be scary too. Basically if it becomes a pattern then consumer spending will crater since people know if they wait their money will be with more in the future. Obviously this effect is less on stuff people have to buy to survive but it’s still not desired.

Yeah inflation means noone can afford stuff but there is almost maximum employment

Deflation results in a lot of stores shutting down since noone is buying anything anymore

High inflation can mean noone can afford more expensive stuff, too, and that those shut down - but generally it’s a better idea to have a small amount of inflation

It’s almost as if capitalism is unsustainable.

That’s just because you don’t understand economics well enough

See, we print extra money when we create debt, which is a great big brain way to scale a very stable and very logical system. It scales with debt, which is basically wealth, right? And as long as everything always grows,

people and enterprises are essentially taxed by the banks for everything that produces the underlying things money representsthe economy grows. And everyone knows you either grow or die, that’s just basic biology… Why do we need a system that makes money after we’re dead?How else would you do it? Have the government print money? How would they know how much to print? Math? Economics are too complex for math, otherwise the economic models I believe in

religiouslywould make accurate predictions.The solution is obvious - we just have to capitalism harder.

And yet here we are, sustaining it. Unless you can convince anybody that won’t continue, you won’t have much luck arguing against it.

deleted by creator

Even the Capitalists are pissed about the rent-seeking coming for their profits from every angle.

What are you even talking about?

Consumers are not going to wait months/years for the real value of their money to increase. They want their gender affirming pickup trucks now.

It hurts the government most because of the debt load it has accumulated, and that is why there is such a strong interest in assuring that deflation never occurs.

True about loans. Inflation benefits all debtors, not just the government. So poorer people who borrow benefit from inflation more than rich people who lend. As others have said, stagnant wages are the real problem.

Regarding deflation, people living in deflation actually do delay purchases. That’s why the deflation persists. There is a cycle that happens where delayed purchases reduce business sales, which causes layoffs. That causes people to delay more purchases.

In your truck example, someone would definitely delay that purchase if they lost their job.

People would stop purchasing non essentials, leading to degrowth which is exactly what we need!

But the shrinking economy would happen in an uncontrolled cycle. It would be too sudden. Even your job at the plant nursery would be cut. That’s why deflation is bad: it’s an uncontrolled brake on the economy.

Inflation benefits all debtors, not just the government. So poorer people who borrow benefit from inflation more than rich people who lend.

This is a common misconception.

When you take out a loan, the rate of inflation is added to the rate at which you borrow. Rich people have inflation hedge alternatives, but you don’t have much credit alternatives. Because demand is less elastic than supply, this “tax incidence” falls on the poor borrower.

The only time this would help poor people is if the inflation is unexpected and thus not priced in already. But that can cause hyperinflation, which hurts everyone.

It’s not a common misconception. If you have a fixed rate loan, say a home loan locked in at 3% or 4% (like many current homeowners), then inflation above normal helps you. When your loan was created, a sub 2% inflation rate was priced in. Anything higher than that means you are winning and your lender is losing.

Your advantage is that you can choose to refinance when rates are low, or keep a good interest rate when rates are high. Also, I don’t know what inflation hedges you are talking about that “rich people” have access to. Anyone can buy stocks, real estate, or inflation protected bonds.

Sorry but yes it is quite common.

What gets priced in is the expected rate, not the current rate. So if we believe 2% is temporarily low, then they’ll price in an inflation rate above 2%. They have more information than you do.

Not everyone can realistically buy the assets you listed. There are tremendous barriers to entry that are dismissed as financial “literacy”.

Inflation isn’t a free money hack for the poor that rich people have left in place out of the kindness of their hearts. It’s why inequality has gotten so much worse since the Nixon Shock.

Yes, it’s the “expected rate” at the time you get the loan. Guess what banks expect when inflation is low? They expect it to stay low. These are fallible people, not emotionless machines.

Banks are run by people who are not going to be around in 30 years when your loan matures. The people who approved all those 3.5% loans in the 2010s do not care that they essentially lose the bank money when inflation is higher. Plus the original bank probably sold the loan to some dumb investors long ago. That’s who takes a bath when interest rates rise (due to inflation).

Most people do not have the option to purchase any of the things you mentioned such as stocks or bonds, as they live paycheck to paycheck, or something close to it. The loans are taken as a matter of necessity, so that much is still relevant.

That’s not true. Most Americans own some investments. 63% of Middle Class Americans ($40,000 to $99,999) own stocks. 65% of Americans own homes.

https://news.gallup.com/poll/266807/percentage-americans-owns-stock.aspx

I gained weight, and I keep gaining weight. When do I deflate? D:

yearly very rare in any given country, but looking at individual months, it can be seen sometimes in the wild, the footage is a bit shaky and low res tho

But then how will the CEO’s afford their third mega yacht.

Their megayachts would actually become cheaper too :)

So where the hell is the deflation?

Japan experienced a long term period of deflation during its “Lost Decade”. China’s currently in a deflationary spiral, which kicked off in 2023 and ran for most of the year.

China is a perfect example of an economy with deflation or dangerously low inflation. In 2023, China recorded a successive series of declines in its CPI, which began to fall in January 2023 and continued till July 2023, dropping from 104 points in January to 102.7 points in July. CPI improved for the next two months but dropped again in October and November 2023. In December 2023, it marked the longest streak of CPI declines in China since 2009. Similarly, the producer price index (PPI) has been in contraction for more than a year. According to Bloomberg Economics, the biggest contributor to the decline in CPI in China was falling food prices as the food prices plunged for six consecutive months from July 2023 to December 2023, dropping from -0.155 to -0.618. Among food, pork prices saw the biggest decline which plunged 26% in December 2023.

Another big economic issue in China is its property market crisis. On January 30, The New York Times reported that China’s home sales dropped by 6.5% and real estate development plunged by 9.6% in 2023, as per the Chinese investment bank, Dongxing Securities Corp Limited (SHA:601198). In December alone, property sales were down by 17.1% year-over-year. The chief economist at Natixis, Alicia Garcia Herrero said the property market has not touched bottom yet. Herrero emphasized, “There is still a long way to go.” The property market crash in China has impacted many firms and over 50 Chinese property firms have defaulted on debt, including the two market giants: The China Evergrande Group (OTC:EGRNQ) and Country Garden Holdings Co Limited (HKG:2007).

Thailand, Libya, Jordan, Bolivia, Azerbaijan, Saudi Arabia, Denmark, Italy… Export-oriented countries can periodically find themselves glutted with their own surplus when supply lines break down and foreign markets fail to absorb the excess.

Shouldn’t be a surprise that China, being a global export leader, is caught in the thick of it due to the emerging US/China trade war and the shut down of the Suez Canal.

It’s an issue with how inflation numbers are reported and I continue to believe that it’s done intentionally to confuse people (or reassure them).

It’s reported year on year but people don’t plan their finances year on year, they think back further than the last year so inflation should be reported both year on year and with a reference year.

It’s funny that other economy stats are actually reported in comparison to major events but not inflation. “The economy has improved X% since the 2008 financial crisis!” is the kind of things that’s getting reported, well, inflation should be reported the same way. How much has it increased since January 2020? That’s what people are feeling right now, not the 3% since August 2023.

It’s specially a problem in the US, and other selected third world countries, where they don’t have yearly minimum wage increases to offset inflation. I live in Brazil, and I get a raise that is always higher to the yearly inflation (thanks for my union), so yes, things are higher as ever, but my salary too.

I’m in the US, I’ve got a solid job, everyone I know says I’m lucky to get raises every year. My raises are still consistently slightly under inflation. Lots of the people I work with don’t understand why that means we’re not actually getting raises, and nobody wants to rock the boat and risk the small amount we do gain each year. It’s wild over here

Annual adjustment or annual + step increment?

Long term the annual adjustment will usually track inflation or be pretty close to it but until you’ve reached your last step you get two wage increases a year so it feels like you’re beating inflation…

Sorry, don’t understand the difference. In Brazil the raise is usually signed in March, but retroactive to the beginning of the year. Is negotiated on base of the past year inflation, so technically we’re always behind, because we get the rise at begging of year, but inflation is a constant process. There’s something I find bullshit and is that the raise is rated by the time you worked on the past year, so if you start working in July, you only get 50% of the negotiated raise. Not sure if it general or something stupid in my union contract.

I think what they meant is if you receive that raise capped or uncapped. Some places have set wage increases based on years worked until a certain ceiling.

So if you have this annual increase and that capped increase at the same time, you might only beat it because of the additional capped increase. That would mean, at some point, your increase in wages will not catch up with inflation anymore

So in most collective agreements I’m used to you have your classification (the job you have) and that classification has multiple pay steps depending on how many years you’ve been in that classification (usually going up every anniversary of you being in that classification) and the annual increase is separate thing.

When you first get hired you usually start at step 1 and go up once step every year while also getting the annual increase so it feels like your salary increases a lot more than inflation, but once you’ve reached the last step all that you get is the annual adjustment that’s usually about the same thing as inflation, sometimes a bit less sometimes a bit more…

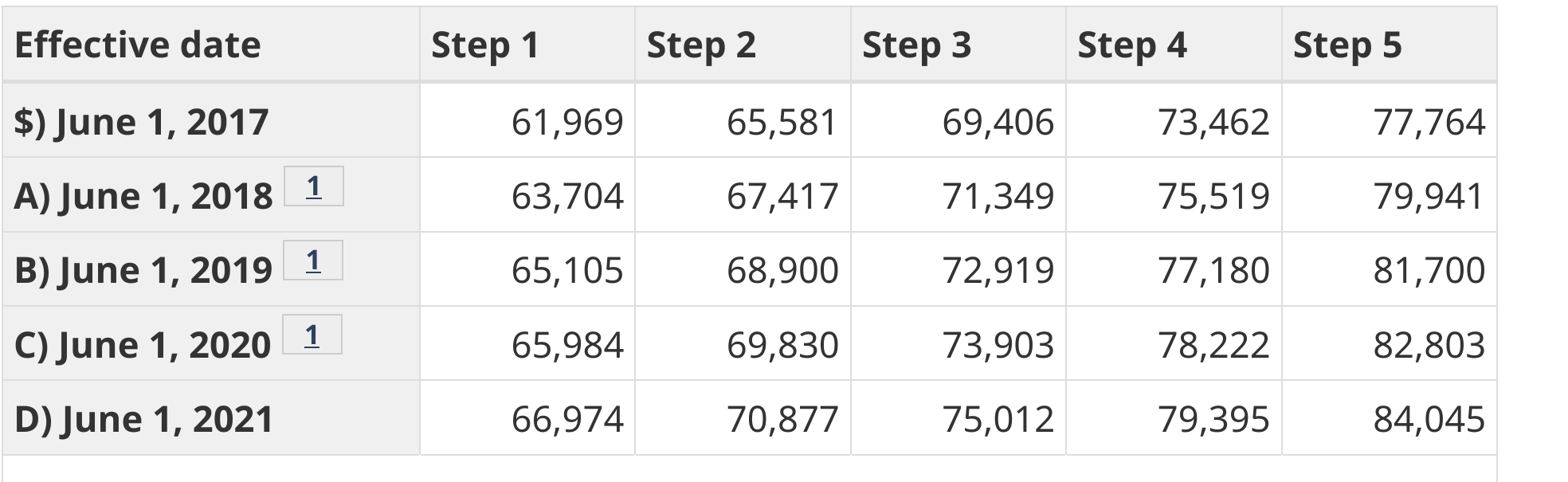

Here’s an example:

Every June 1st you get a raise, but you also get one every anniversary for the first four years so it seems like your salaries increases by a lot during that time. Someone hired June 2nd 2017 would go from 61969 to 84045 after four years but someone that was there since 2010 would go from 77764 to 84045 during that time because they had already reached the last step.

Ok, I get it. Nah, there’s no such thing as the steps, at least not in my union (insurance workers of São Paulo). You get your annual rise, usually a bit more that the inflation and that it. Anything else is a discretion for the companies.

Interesting, so that would mean a new employee starts at the same salary as one that’s been the for ages?

Or less, and is always behind 🤷♂️

Well then people might start asking questions like why X is up Y% but the ingredients for X have only gone up Z% in total

But people are already wondering that…

They think people are too dumb to understand that zero is not the target for inflation. They want to make the good news they’re reporting sound like good news.

You can disagree with their approach, but where they’re coming from makes sense. After all, the OP in the screenshot exists.

I think it’s reported that way because traders and other people adjacent to the financial sector are trying to figure out when the Fed is likely to lower rates. I don’t really see inflation numbers reported outside financial articles.

To give the original question answer slightly more (probably unfounded) credit, there are a lot of people out there who know the basics of what inflation is, but also seem to have a fundamental assumption that in a “normal” economy, wages will also increase at the same pace as inflation, resulting in a net zero effect on a person’s buying power overall. Even though, yes, things are always getting a little more expensive in absolute terms, they don’t seem more expensive. So the answer to the question someone with those assumptions might have actually been trying to ask is that even if inflation returns to a “normal” rate, wages have remained stagnant for a long time and aren’t keeping pace with inflation like they used to, so now things actually are more expensive in a relative sense.

People really need to know what “rate” means.

Or we should switch to talking about affordability indices rather than inflation. Inflation isn’t a particularly informative figure for most people. What people really care about is the purchasing power of their income, not what the change in dollar value is.

I work with statisticians who also struggle to differentiate a decrease from a decrease in rate of increase.

The other issue is inflation isn’t consistent across all product prices, some have been in short supply or high demand, and others have prices gouged because there isn’t enough competition…

People don’t understand this about inflation and it will disappoint them very soon once inflation is fully back to rates we saw pre-pandemic.

Grocery prices aren’t coming down. Housing prices aren’t going down. Utility costs aren’t going down. The best we can hope for is for them to not increase as fast as they have the last four years and for the usual fluctuations in things like gas or electricity costs to fluctuate down more than up.

The best we can hope for is for them to not increase as fast as they have

That’s what inflation going down means. Inflation is the rate in which prices increase. Saying “inflation going down” means that the rate prices increase is not as much. “Inflation going down” still means prices are increasing. People are confusing “inflation going down” with deflation, which means prices are decreasing.

Yeah, that’s exactly what I mean. I don’t think most people understand that, and it will lead to people losing faith in experts when they’re told inflation is back to pre-pandemic levels but prices aren’t.

Second order derivatives mmmmmmmm

This is why we need to teach people calculus. At the very minimum - derivatives.

wait til they find out that the derivatives market is vastly larger than the stock market itself.

I’m not sure if you’re joking, but those are two different types of derivatives.

Not sure how you derived that.

My baby boy was born at 8 lbs 4 oz.

Five years later he weighed 60 lbs.

Five years after that he weighed 110 lbs

Five years after that he weighed 130 lbs

Five years later he weighed 180 lbs.

Five years later he weighed 195 lbs

So his weight gain is down. But now he’s a fully grown adult. When does shrink back down to the size of a baby?

old lady deflation:

I think the closest you’ll get to that is when he starts a small economy of his own.

This is one way to own the lbs.

https://www.youtube.com/watch?v=jsU1AKrlc4U&t=101s explains how the politicians frame it

Push is down.

Pull (which until the 80s was theoretical) is way up.